Americans are paying a record high cost to host their July 4th cookouts this year as inflation, like the weather, is still hot.

According to the American Farm Bureau Federation (AFBF), a traditional Independence Day barbecue for 10 will cost $71.22, up from $59.50 in 2021. Higher prices for burger meat, buns, cheese and favorite sides like chips all add up to a painful bill to light up that grill.

“Nationally, this means we are surpassing $7 per person for the first time, with the total meal coming to $7.12 a person,” said AFBF economists Bernt Nelson and Samantha Ayoub. “Only two dishes decreased in price while everything else on your table rose, on average. Your grocery bill may be a shock, but it is in line with the inflation that has roiled the economy — including the farm economy — over the last several years.”

AFBF’s market basket survey enlisted volunteers from around the nation to catalog prices for a complete, homemade cookout featuring cheeseburgers, chicken breasts, pork chops, potato chips, homemade potato salad, fresh-squeezed lemonade, chocolate chip cookies and, of course, ice cream.

FED’S POWELL: PRICES ARE ‘BACK ON DISINFLATIONARY PATH,’ BUT MORE CONFIDENCE IS NEEDED

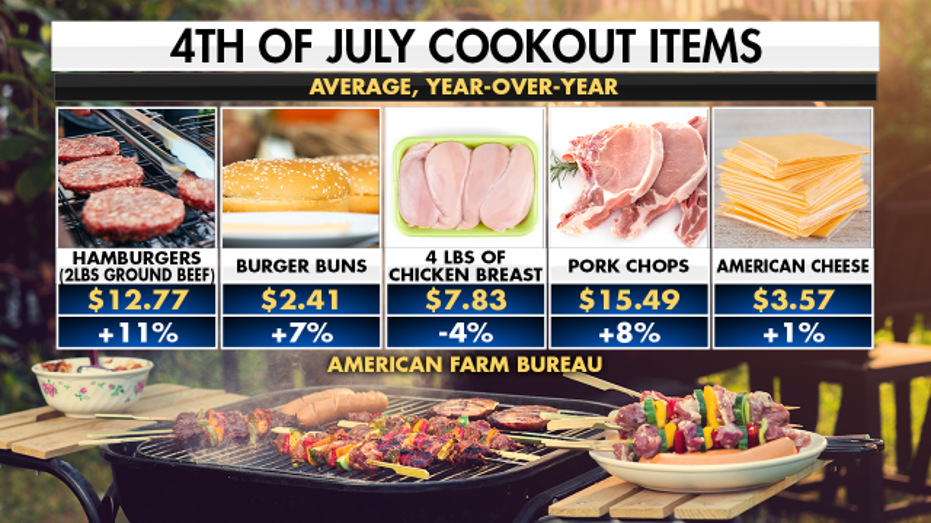

Meat is the biggest part of your barbecue budget, accounting for about half of the total cookout cost, according to AFBF.

Burgers are the most expensive: Two pounds of ground beef costs $12.77 on average, up from $8.20 just three years ago. Blame overall cattle inventory, which is at the smallest it has been in 73 years, while beef in cold storage is also at record lows, contributing to higher prices.

Pork chops are pricier, too, with costs up 8% nationally over last year. Three pounds of pork chops will cost $15.49 on average, and $19.91 in California, where the state banned in-state meat sales from animals whose production didn’t meet California animal welfare standards, regardless of where they were raised, AFBF said.

The good news is that two pounds of chicken breast will cost an average of $7.83, down 4% since 2023 and down over 13% from the record high set in 2022 amid a bird flu outbreak.

FED HOLDS RATES STEADY AT 23-YEAR HIGH, PROJECTS JUST ONE CUT THIS YEAR

Moving on to fixings, burger buns will cost an average of $2.41 at the store, up 7% year-over-year. American cheese will cost about the same as last year, up only 1% to $3.57.

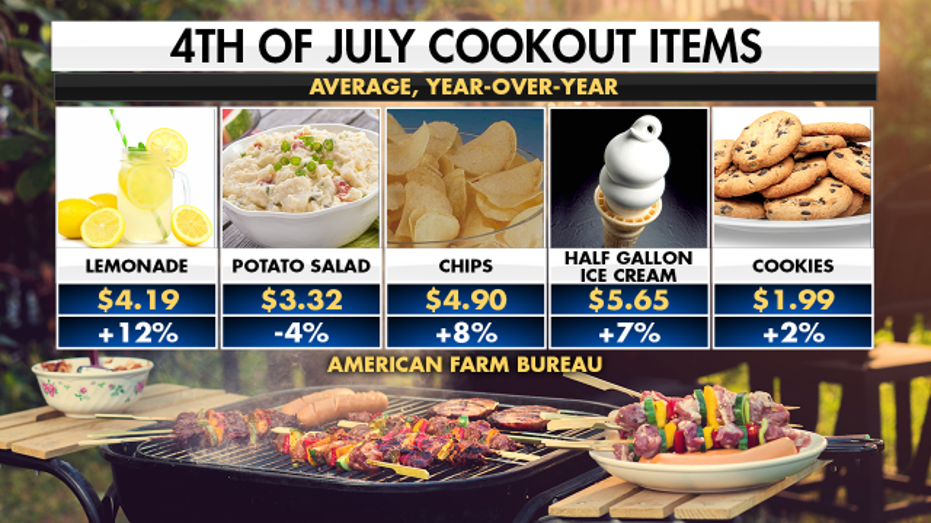

Lemonade is 12% more expensive, costing $4.19 on average, because its ingredients are pricier. Lemon production has suffered after a citrus greening disease outbreak late last year in California, where most U.S. lemons come from, shooting prices up. Sugar is also more expensive, thanks to a decrease in global production and higher tariffs on imports from Mexico.

AFBF’s market basket is rounded out with side dishes and desserts, including chips, potato salad, ice cream and chocolate chip cookies.

A large bag of chips costs $4.90 on average, an 8% increase over last year. Potato salad is one of two dishes, along with chicken breast, that is less expensive, down 4% from last year. Prices for both potatoes and eggs have fallen, though egg inventories are still recovering from the bird flu epidemic and prices are higher than historical norms.

WHY CAN’T YOU FIND A HOUSE FOR SALE?

Chocolate chip cookies are about 2% more expensive, costing $1.99. A half-gallon of ice cream is up 7% from last year, costing $5.65 on average.

Though prices are up overall, the latest inflation reports have shown the economy is cooling off slightly in what officials hope will be a continuing trend. Federal Reserve Chairman Jerome Powell on Tuesday expressed optimism that inflation was headed downward, based on the consumer price index reports from April and May.

“I think the last reading, and the one before it to a lesser extent, do suggest that we are getting back on a disinflationary path,” Powell said at a central bank forum in Sintra, Portugal. “We want to be more confident that inflation is moving sustainably down to 2% before we start the process of loosening policy.”

Officials voted at their most recent meeting in May to hold interest rates steady at a range of 5.25% to 5.5%, the highest level since 2001. Although policymakers left the door open to rate cuts later this year in their post-meeting statement, they also stressed the need for “greater confidence” that inflation is coming down before easing policy.

Since then, there has been some evidence that inflation is starting to ease again. The May personal consumption index showed that inflation had cooled slightly to 2.6%, from a high of 7.1%. At the same time, core prices — which are more closely watched by the Fed because they strip out volatile measurements like food and energy — also climbed 2.6%, the slowest annual rate since March 2021.

“That represents really significant progress,” Powell said. “We’ve made a lot of progress. We just want to understand that the levels that we’re seeing are a true reading of what’s happening with underlying inflation.”

FOX Business’ Megan Henney contributed to this report.

Read the full article here