The Chinese economy recorded the first period of negative foreign direct investment (FDI) in decades, marking another significant and worrying indicator of Beijing’s sluggish post-pandemic recovery.

“Conducting business in China is getting increasingly difficult,” Josh Birenbaum, deputy director for the Center on Economic and Financial Power at the Foundation for Defense of Democracies, told FOX Business.

“China’s economy is unquestionably in rough shape right now,” he said, stressing that the FDI numbers “are a big part of that.”

FDI for China in Q2 2023 totaled $4.9 billion, a whopping 87% decrease on the year and the largest drop since 1998, when comparable data was first available, Nikkei Asia reported. FDI has dropped more than 50% since Q2 2022, but the latest drop is the lowest FDI has hit on record.

CHINA EXPERT WARNS US IS ‘FUELING’ THEIR MILITARY BUILDUP ‘CONFIGURED TO KILL AMERICANS’

The outflow of investment totaled around $11.8 billion, according to Axios. Goldman Sachs analysts suggested “some” of the weakness could have resulted from “multinational companies repatriating earnings,” but regardless may indicate how quickly expectations about China’s growth have “shifted.”

China has not regained the kind of financial muscle it was throwing around before the pandemic, with several issues resulting from the global supply chain crisis having forced countries to reconsider their reliance on China for production and trade.

The U.S. has made a deliberate effort during the Trump and Biden administrations to diversify and decrease its reliance on China, resulting in Canada and Mexico exporting more to the U.S. than China as of earlier this year.

Countries like Germany have also announced new plans to cut down on their reliance to China, turning instead to emerging and low income countries to try and fill the gap and develop greater independence, Reuters reported.

STUART VARNEY: GAVIN NEWSOM’S CHINA TRIP SENDS A MESSAGE TO BIDEN: ‘STEP ASIDE’

Birenbaum blamed a number of “very problematic” laws China passed in recent years that have amounted to an alarming lack of transparency and increase in government overreach that has and continues to dissuade trading partners from developing closer ties.

“Particularly, you’re looking at the national security and the NTSB laws that raised the prospect of fines, harassment, jail time for conducting basic risk assessment and due diligence that everybody multinational needs to do in order to operate,” Birenbaum explained.

“It’s very difficult for companies to operate in a condition where they can’t assess risk, and these laws make it virtually impossible to do that,” he continued, adding that the “lack of basic transparency” makes it “impossible” to comply both with the domestic laws and the transnational laws of “other jurisdictions.”

“The U.S. Weak or Forced Labor Prevention Act, the German corporate due diligence law, the French law Vigilance and others require companies to do basic due diligence on human rights and other issues, and China refuses to let companies do that level of assessment and investigations.”

VIDEO OF MAN URINATING INTO VAT OF TSINGTAO BEER INGREDIENTS PROMPTS INVESTIGATION

One example Birenbaum noted was a new law passed by China’s highest court last month that made it easier for authorities to crack down on individuals who slander or smear private businesses, which was announced as protection for the private sector but merely “further tamps down on free speech and makes conditions even less conducive for investment from Western businesses.

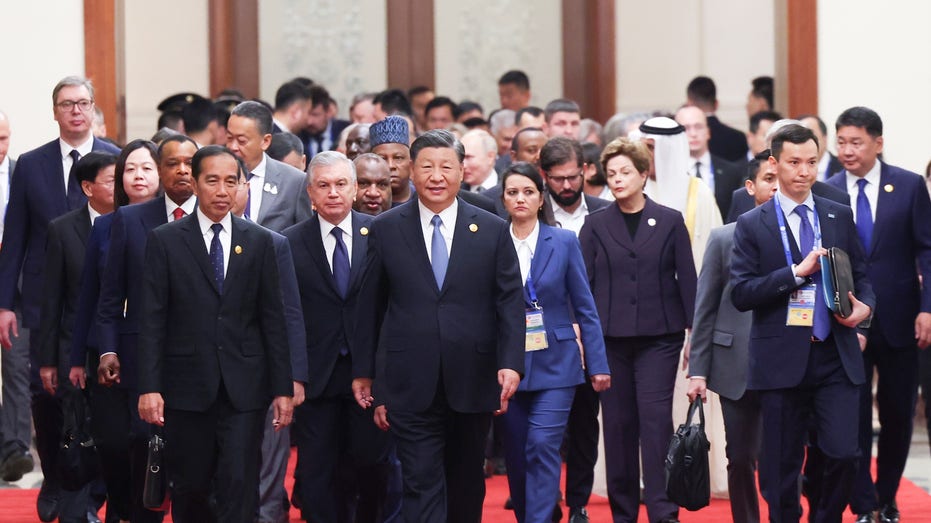

Birenbaum noted that China has already taken a number of “small steps” to handle the issue, and he expects Chinese President Xi Jinping to continue addressing the “major issues underlying the change,” such as relaxing some of its capital controls for foreign entities in Shanghai and Beijing.

Gordon Chang, Gatestone Institute senior fellow and author of “China is Going to War,” argued that the new numbers indicate “the beginning of a long-term trend.”

“After years of debt-fueled growth, [the economy] looks to be in long-term decline if not on the edge of a crash,” Chang told FOX Business. “More important, however, is Xi Jinping’s response.”

“[Xi] has been centralizing the economy in state institutions, attacking foreign business, and cutting the country off from the outside,” Chang argued, claiming that Xi is “doing his best to return China to the 1950s.”

“His policies are undermining economic growth,” he said. “Since the beginning of the ‘reform era’ at the end of the 1970s, the primary basis of the legitimacy of the Communist Party has been the continual delivery of prosperity.”

“Now that the economy is stumbling—it is not growing at the reported 5.2% pace for the first three quarters of this year and may in fact be hovering around 0%—the Party’s primary basis of legitimacy is nationalism,” he added. “China’s leader has domestic incentives to lash out and be reckless.”

Read the full article here